Suppliers surveyed in China (38.2%) appear to be the most likely of all their peers in Asia Pacific to sell on cash terms to their B2B customers.

Sales on credit terms

China, by far the largest economy of Asia, is gradually rebalancing towards a more consumption-driven economy resulting in growth slowdown and weaker import demand. The probability of the GDP growth slowing to 5% or less per annum in the next two years is low, but the impact of it would be wide, affecting China, its trading partners and the world economy as well. This situation would pose a multitude of risks to business, particularly affecting companies trading internationally. This prompts businesses to protect their liquidity position against the risk of payment default by their domestic and foreign B2B customers purchasing on credit. Survey findings in China shed light on how suppliers in the country manage trade credit risk in the challenging business environment.

Chinese suppliers the least likely in Asia Pacific to offer credit terms to B2B customers

With an average of 38.2% of the total value of B2B sales transacted on credit terms (regional average: 46%), suppliers surveyed in China appear to be the most likely of all their peers in Asia Pacific to sell on cash terms to their B2B customers. This behaviour can be read as an expression of the overall payment culture in China, which prioritizes cash over other methods of payment, as for example credit cards. This highly conservative stance towards granting trade credit in B2B transactions was also observed in Taiwan, where slightly less than 40% of the total value of B2B sales was transacted on credit, below the 46% average for Asia Pacific.

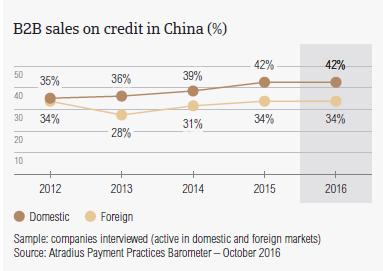

Domestic B2B customers of suppliers in China highly more likely to be offered credit terms than foreign customers

Along with the most conservative stance towards granting trade credit in B2B transactions, suppliers surveyed in China appear to be highly more likely to offer credit terms in their home market than abroad. 42% of domestic and 34.4% of foreign B2B sales in China were transacted on credit. This appears to be consistent with the regional pattern (averages for Asia Pacific: 50.3% domestic and 42% foreign). This higher percentage of sales on credit to domestic customers may be reflective of a greater familiarity with domestic business practices, but it may also suggest a higher level of trust when dealing with compatriots.

Overdue B2B invoices (%)

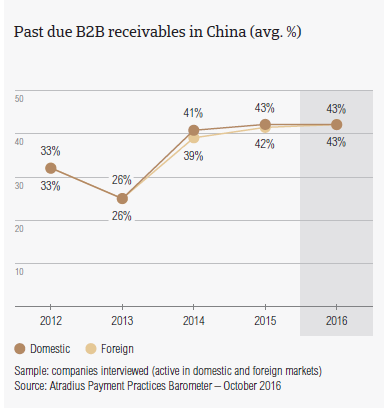

91% of respondents in China (88% at regional level) reported late payment of invoices by domestic and foreign B2B customers over the past year. This resulted in an average of 43% of the total value of B2B receivables remaining unpaid at the due date. The percentage of overdue B2B invoices in China is in line with the average for Asia Pacific overall (44%).

Domestic and foreign invoices in China are paid late equally as often

On average, 43% of the total value of B2B invoices in China were paid late. Domestic B2B customers in China pay invoices late equally as often as foreign customers do (this is the same as in Japan). Compared to last year, both the domestic and the foreign default rates in China remained steady. This is likely to reflect the great emphasis that Chinese suppliers put on the security aspects of trade relations, above all, a thorough evaluation of both the creditworthiness and payment history of B2B customers to whom credit terms are offered.

Late payment of (domestic and foreign) B2B invoices in China is reflected in the average Days Sales Outstanding (DSO) figure resulting from survey responses. In China, this averages 39 days (regional average: 41 days), is the third lowest after that of Australia and Hong Kong, and is stable compared to one year ago. The steadiness of this indicator is likely to reflect the great efficiency of Chinese suppliers in collecting long outstanding invoices of high value. This may indicate sound credit management, within a business culture that, as seen earlier, values secure trade.

Twice as many Chinese suppliers expect an increase in DSO over the next 12 months (36%) than an improvement/decrease (18%). This may reflect suppliers’ concerns over the likely impact of the economic slowdown on their businesses. However, 46% of respondents in the country do not anticipate changes in DSO over the same time frame. These response rates, which are consistent with those at regional level, reflect the challenging business conditions in which companies across most of the Asia Pacific region are currently operating.

Chinese suppliers concerned about cost containment and cash flow levels

Around 20% of the suppliers surveyed in China (in line with the regional response rate) consider cost containment and maintaining adequate cash flow levels to be the biggest challenges to business profitability this year. This tallies with the earlier mentioned concerns that DSO might increase, and potentially worsen the liquidity position of Chinese businesses, besides increasing the financial and administrative costs of carrying long overdue trade receivables. It is worth noting that more respondents in China (11%) than in Asia Pacific (7%) consider the collection of outstanding invoices in emerging economies to be the biggest challenge to profitability. This may indicate that Chinese suppliers consider efficient collection of outstanding invoices to be of paramount importance, and evidence of this is likely to be seen in the DSO steadiness over the past year.

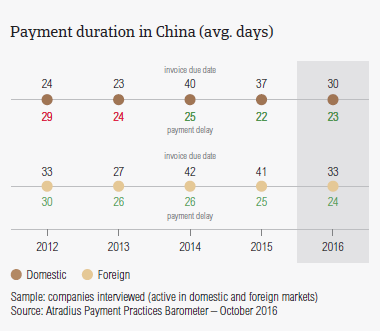

Payment duration (average days)

In China, suppliers request payment of domestic B2B invoices within an average of one month of the invoice date (average for Asia Pacific: 32 days). Foreign customers are requested to settle invoices almost within the same time frame (on average, within 33 days of invoice date). Over the past year, Chinese suppliers have shortened the average payment terms offered to both domestic and foreign B2B customers by an average of eight days. The shorter payment terms may reflect Chinese suppliers’ concerns about the impact of the challenging economic environment on the liquidity position of their B2B customers.

Chinese suppliers turn past due invoices into cash, on average, after two months from invoicing

Despite being granted notably shorter payment terms than one year ago, both foreign and domestic B2B customers settle past due payments almost within the same time frame as they did last year (on average, 23 days after the invoice due date). This means that the Chinese suppliers interviewed turned overdue invoices into cash, on average, around two months from invoicing. This is in line with the average for Asia Pacific.

Key payment delay factors

Fewer suppliers in China (nearly 36%) than in Asia Pacific (46%) are of the opinion that their domestic B2B customers pay invoices late due to liquidity issues. The Chinese response rate for this reason is half of that recorded one year ago. Insights into survey findings suggest that this may be due to the fact that domestic customers now delay payment of invoices more often for reasons that are unrelated to their creditworthiness, such as inefficiencies of the banking system (cited by 24% of surveyed suppliers, compared to 19% last year) and incorrect information on the invoices (mentioned by 15% of surveyed suppliers, three time as many as last year).

The complexity of the payment procedure is the most frequent reason for late payment from foreign customers

Consistent with the opinion expressed by most of the suppliers surveyed in Asia Pacific, the most frequent issue affecting credit based transactions between Chinese suppliers and their overseas customers is the complexity of the payment procedure. This was cited by 42% of suppliers surveyed in China and 38% at regional level. The inefficiencies of the banking system play a major role in delaying foreign payments according to 30% of the suppliers surveyed in China. This response rate is equal to that recorded at regional level, suggesting that this is a recurring issue affecting the settlement of invoices related to B2B transactions between Asia Pacific buyers and their overseas customers.

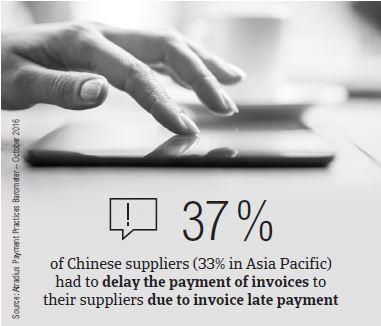

Nearly 4 in 10 suppliers in China paid their own suppliers late due late payments by their customers

Regardless of the reasons why customers pay invoices late, this appears to cause a ripple effect throughout the whole supply chain in China. 37% of Chinese suppliers (33% in Asia Pacific) had to delay the payment of invoices to their suppliers. 25% of the Chinese suppliers surveyed had to either take specific measures to correct cash flow (regional response rate: 34%) or to pursue additional financing from factors or banks (regional response rate: 24%). To protect their businesses against the risk of payment default by B2B customers, 53% of Chinese suppliers (45% in Asia Pacific) will check the creditworthiness of their customers more often over the next 12 months. 45% will either sell on cash terms or request secured forms of payment from their B2B customers more often over the next 12 months.

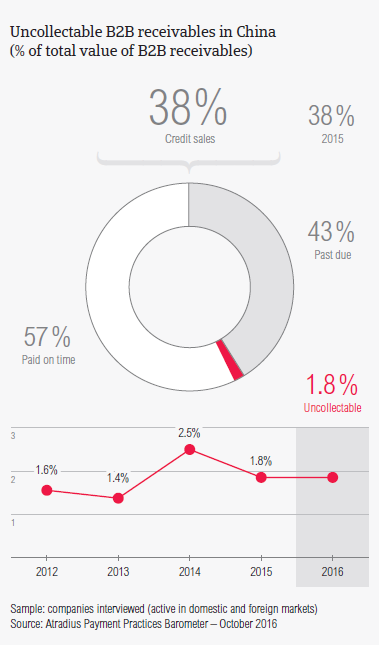

Uncollectable receivables

The proportion of B2B receivables reported by Chinese suppliers as being written off as uncollectable (1.8% of the total value of B2B receivables) is below the average for Asia Pacific (2.1%). Domestic uncollectable receivables were written off as often as foreign ones. Compared to last year, the percentage of write-offs in China remained steady. This likely reflects a strong focus of businesses in China on efficient collection processes. Uncollectable domestic B2B receivables originate most often from the chemicals, construction, consumer durables and electronics industries.

Half of the suppliers surveyed in China wrote off uncollectable receivables due to the customers’ bankruptcy

In line with the regional response rate, nearly half of the suppliers surveyed in China wrote off receivables as uncollectable most often because the customer went bankrupt or out of business.

Around 30% of suppliers surveyed wrote off receivables as uncollectable due to a the failure of the collection attempts or because the debt was too old to be collected.

For more insights into the B2B receivables collection practices in China and worldwide, please see the Global Collections Review by Atradius Collections (free download after registration), available from October 2016 on atradiuscollections.com

Payment practices by industry in China

Suppliers surveyed in China reported trading on credit terms mainly with B2B customers in the consumer durables, construction, ICT, logistics, food, machines and chemicals industries. Invoice payment terms extended to B2B customers in the ICT industry appear to be notably more relaxed (averaging 40 days from the invoice date) than those offered in the other industries with which suppliers surveyed in China trade on credit. These latter do not differ significantly from the country and regional averages (around 30 days each).

Despite being granted above average terms to settle their invoices, B2B customers in the ICT industry take the longest to pay overdue receivables (on average, within 30 days after the invoice due date). However, it is the chemicals industry which generated the largest proportion of past due B2B invoices. Around 60% of the total value of B2B invoices issued by suppliers in China to B2B buyers in the chemicals industry were paid late. The same proportion of overdue receivables was generated by the construction sector.

Based on survey responses, late payment of invoices due to customers’ liquidity constraints occurred most often in the food and beverages, as well as in the metals industries (53% of suppliers surveyed in China cited this). Late payment in the ICT and machines industry was most often due to the inefficiencies of the banking system (according to nearly half of the Chinese suppliers surveyed).

Chinese suppliers expect customers’ payment practices in the construction, chemicals and ICT industries to worsen

An improvement in B2B customers’ payment behaviour is expected in most of the industries in China. Around 25% of Chinese suppliers, in contrast, expect deterioration in the payment behaviour in either the construction, chemicals or ICT industries in China over the next 12 months. No significant change is anticipated in respect to payment practices of B2B customers in other industries.

Documenti collegati

3.44MB PDF

3.07MB PDF

34KB PDF